Third party car insurance sits at the bottom rung when it comes to car cover in South Africa, but it draws plenty of interest for one reason. More than 70 percent of South African drivers are uninsured, leaving massive risks on the road. That sounds shocking, right? There’s a catch though. Choosing third party insurance might seem risky, but for owners of older cars or those on a tight budget, it can turn out to be the quickest legal solution to avoid paying for other people’s damages. Most people miss just how narrowly focused this type of cover is.

Quick Third Party Car Insurance Summary

| Takeaway | Explanation |

|---|---|

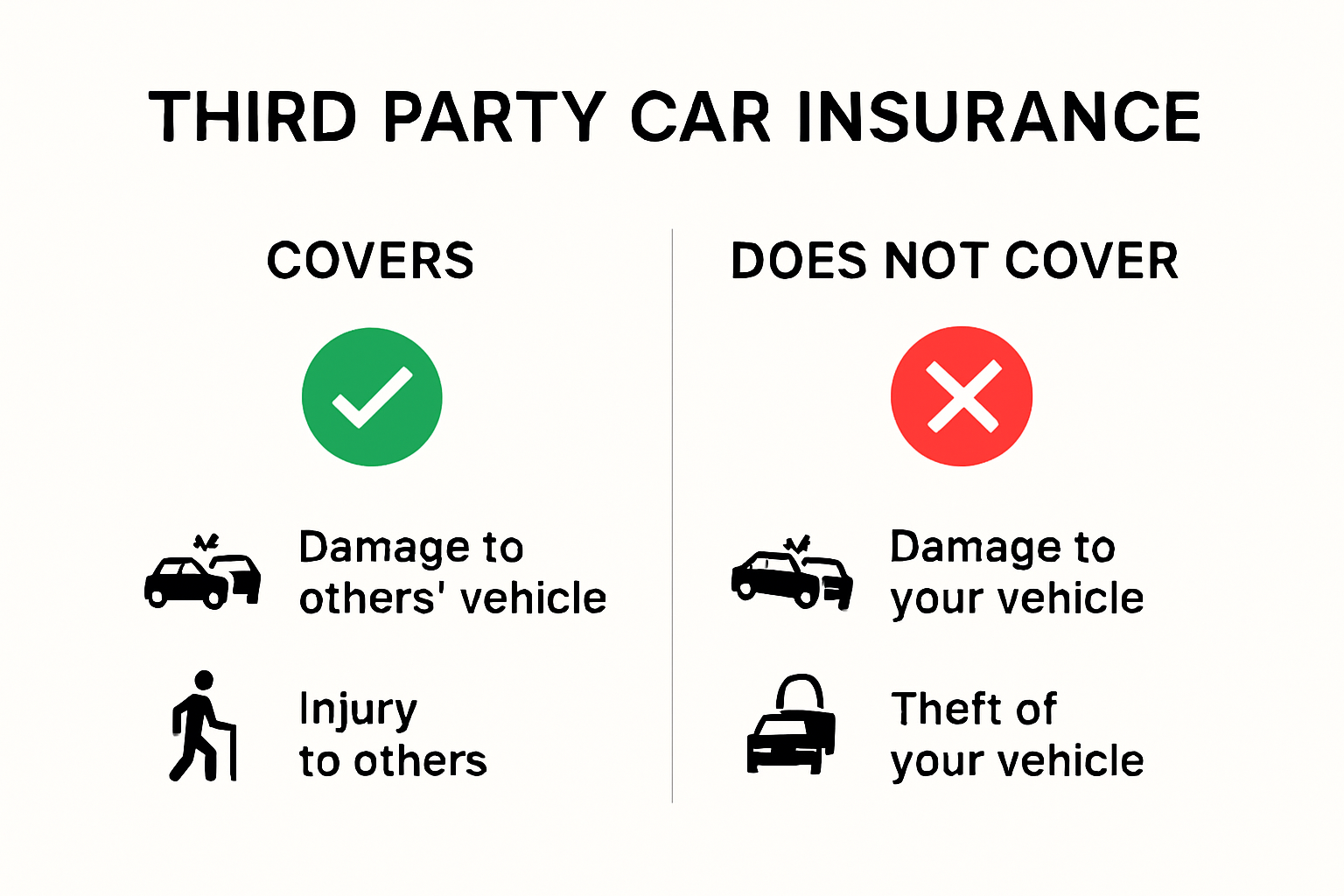

| Understanding Coverage Limitations | Third party car insurance provides essential external liability protection but excludes damage to your own vehicle, theft, fire, and personal medical expenses. |

| Ideal for Budget-Conscious Individuals | This insurance option is suitable for those with limited financial resources, older vehicles, or individuals seeking minimum legal coverage, thus helping to lower monthly expenses. |

| Assessment for Suitability | Evaluate personal circumstances such as vehicle age, financial situation, and risk tolerance to determine if third party insurance meets your coverage needs effectively. |

| Importance of Policy Comparison | When selecting a third party policy, compare multiple insurers on premium costs, coverage extent, and claims efficiency to find the best option. |

| Strategic Cost Management Techniques | Implement strategies such as maintaining a clean driving record, bundling policies, and considering a higher voluntary excess to optimize insurance costs while ensuring adequate coverage. |

What Does Third Party Car Insurance Cover?

Third party car insurance represents the most basic and legally mandated form of vehicle protection in South Africa. Understanding its scope and limitations is crucial for every vehicle owner navigating the complex world of automotive insurance.

The Core Protection Mechanism

At its fundamental level, third party car insurance provides financial protection against damages you might accidentally cause to another person’s property or vehicle. Unlike comprehensive insurance, this coverage focuses exclusively on external liability rather than protecting your own vehicle. According to iMoto News, this type of insurance ensures you are not personally financially responsible for expensive repairs or replacements resulting from an accident where you are at fault.

The primary scenarios covered under third party car insurance typically include:

- Property Damage: Compensation for damages to another person’s vehicle or physical property caused by your car

- Third Party Injury: Medical expenses and potential legal costs if you are responsible for injuring another person in a road incident

- Legal Liability: Protection against potential legal claims arising from accidents where you are deemed responsible

What Third Party Insurance Does Not Cover

It is equally important to understand the significant limitations of third party car insurance. According to Auto24, this insurance type explicitly excludes several critical scenarios:

- Damage to your own vehicle in an accident

- Theft of your vehicle

- Fire damage to your car

- Personal medical expenses

- Damages from intentional acts

The Autogen Motor Blog emphasizes that while third party insurance provides essential legal protection, it offers minimal personal vehicle protection. This makes it an economical choice for older, lower-value vehicles or drivers seeking the most affordable insurance option.

Determining If Third Party Insurance Is Right For You

Choosing third party car insurance requires careful personal assessment. Ideal candidates typically include:

- Owners of older vehicles with significantly depreciated value

- Drivers with limited financial resources

- Individuals seeking the most budget-friendly insurance option

However, for newer vehicles or those with substantial value, the risks of third party only coverage might outweigh the potential savings. Carefully evaluating your personal financial situation, vehicle value, and risk tolerance is essential when selecting your insurance strategy.

Remember that while third party car insurance provides fundamental protection, it represents the most basic level of coverage available. Your specific circumstances will determine whether this insurance meets your comprehensive protection needs.

Who Should Consider Third Party Car Insurance?

Deciding whether third party car insurance is the right fit requires a nuanced understanding of your personal financial landscape, vehicle value, and risk tolerance. This insurance option serves specific driver profiles who seek affordable protection with strategic financial considerations.

Budget Conscious Vehicle Owners

For South African drivers operating on tight financial margins, third party car insurance emerges as a strategic choice. According to Auto24, this insurance type provides essential legal protection while maintaining significantly lower premium rates compared to comprehensive coverage. Ideal candidates typically include:

- Individuals with limited monthly income

- Students and young professionals

- Owners of older vehicles with diminished market value

- Drivers seeking minimum legal road coverage

The financial pragmatism of third party insurance becomes particularly attractive when the vehicle’s replacement value is relatively low. By prioritizing external liability protection over personal vehicle coverage, drivers can substantially reduce their monthly insurance expenditure.

Vehicle Age and Depreciation Considerations

iCart Insurance highlights that third party car insurance represents an intelligent option for vehicles that have experienced significant depreciation. Owners of older vehicles where comprehensive insurance premiums exceed the car’s actual market value can benefit tremendously from this streamlined coverage approach.

Key indicators suggesting third party insurance might be appropriate include:

- Vehicles older than 10 years

- Cars with market values below R50,000

- Vehicles fully paid off and without outstanding financing

- Models with high maintenance costs relative to their value

Specific Driver Profiles

Beyond financial considerations, certain driver profiles are particularly well suited to third party car insurance. Insurance Insights suggests this coverage is optimal for individuals who:

- Drive infrequently or limited distances

- Maintain multiple vehicles with varying insurance needs

- Possess alternative transportation options

- Want fundamental legal protection without extensive personal vehicle coverage

Ultimately, selecting third party car insurance demands careful personal assessment. While it offers economical protection, it requires drivers to accept potential out-of-pocket expenses for personal vehicle damage. Thoroughly evaluating your specific circumstances, risk tolerance, and financial capacity will determine whether this insurance approach aligns with your broader financial strategy.

Remember that insurance is not a one-size-fits-all solution. Your unique situation dictates the most appropriate coverage, and third party car insurance represents just one potential pathway in managing automotive financial risk.

Comparing Third Party vs Comprehensive Cover

Navigating the insurance landscape requires understanding the fundamental differences between third party and comprehensive car insurance. Each coverage type offers distinct protection levels that can significantly impact your financial security and risk management strategy.

Financial Protection Scope

According to Auto24, the primary distinction between these insurance types lies in their coverage breadth. Third party insurance provides basic external liability protection, while comprehensive cover offers a more holistic approach to vehicle protection.

Key Differences in Coverage:

- Third Party Insurance

- Covers damage to other vehicles and property

- Protects against legal liability

- Lowest premium option

- Comprehensive Insurance

- Includes third party liability coverage

- Protects your own vehicle against theft, fire, and accidental damage

- Higher premium but broader protection

Cost and Risk Analysis

Financial experts emphasize that the choice between these insurance types is not merely about cost but about comprehensive risk management. Insurance Insights highlights that while comprehensive insurance comes at a higher premium, it provides substantial financial protection that can prevent significant out-of-pocket expenses.

Consider the potential financial implications:

- A third party policy might save you money on monthly premiums

- Comprehensive cover protects against unexpected vehicle replacement costs

- Your vehicle’s age, value, and condition play crucial roles in determining the most suitable option

Selecting the Right Coverage

Deciding between third party and comprehensive insurance requires careful evaluation of personal circumstances. Auto24 recommends comprehensive cover for:

- Newer vehicles

- High-value cars

- Vehicles with outstanding finance

- Drivers in high-risk areas

Third party insurance might be more appropriate for:

- Older vehicles with low market value

- Drivers with limited financial resources

- Cars that are fully paid off

Ultimately, your insurance choice should balance financial protection with affordability. While third party insurance provides essential legal coverage, comprehensive insurance offers peace of mind by protecting your most significant asset. Carefully assess your personal risk tolerance, vehicle value, and financial capacity to make an informed decision that provides optimal protection for your specific situation.

Remember that insurance is not a static choice. Regularly review your coverage as your vehicle ages, your financial situation changes, and your personal risk profile evolves.

Tips to Choose the Right Third Party Policy

Selecting the most appropriate third party car insurance policy requires strategic consideration and thorough research. Making an informed decision can protect you from potential financial risks while ensuring comprehensive liability coverage.

Comprehensive Policy Comparison

According to iCart Insurance, comparing multiple insurance providers is crucial when choosing a third party policy. Key evaluation criteria should include:

- Premium costs

- Coverage extent

- Claims processing efficiency

- Customer service reputation

- Excess fees and payment structures

Experts recommend obtaining quotes from at least three different insurers to ensure you receive competitive pricing and optimal coverage. This approach allows you to understand the nuanced differences between various third party insurance offerings.

Critical Coverage Elements

Insurance South Africa emphasizes the importance of verifying specific coverage details before finalizing your third party policy. Essential elements to scrutinize include:

- Comprehensive third party property damage protection

- Medical expense coverage for injured parties

- Legal defense fee inclusions

- Repair cost provisions for damaged vehicles

- Geographical coverage limitations

Carefully reading the policy’s fine print can reveal crucial details that might significantly impact your protection level. Some policies may have subtle variations in coverage that could affect your financial liability in specific scenarios.

Strategic Cost Management

Managing your third party car insurance costs requires a strategic approach. Insurance Insights suggests several techniques to optimize your insurance investment:

- Consider higher voluntary excess to reduce monthly premiums

- Maintain a clean driving record

- Bundle insurance policies for potential discounts

- Review and update your policy annually

- Investigate no-claim bonus opportunities

Drivers should recognize that the cheapest option is not always the most cost-effective. Balancing affordability with comprehensive protection requires careful evaluation of your personal risk profile and financial capacity.

Ultimately, selecting the right third party policy demands a holistic approach. Beyond comparing prices, you must assess the insurer’s reliability, claims processing efficiency, and long-term financial stability. Your chosen policy should provide not just legal compliance, but genuine peace of mind.

Remember that insurance is a dynamic protection mechanism. Regularly reassessing your coverage ensures you remain adequately protected as your vehicle and personal circumstances evolve.

Frequently Asked Questions

Third party car insurance is the most basic form of vehicle insurance in South Africa, covering damages you may cause to another person’s vehicle or property. It does not protect your own vehicle from damages, theft, or fire.

Third party car insurance is ideal for budget-conscious drivers, owners of older vehicles with low market value, and individuals who need the minimum legal coverage to drive on South African roads.

Third party car insurance does not cover damages to your own vehicle, theft, fire, personal medical expenses, or any damage resulting from intentional acts.

To choose the right third party car insurance policy, compare multiple insurers based on premium costs, coverage extent, claims efficiency, and customer service to find the best fit for your needs.

Ready to Break Free From Uncertainty on the Road?

Whether your biggest worry is the sheer number of uninsured drivers in SA or the tight budget that keeps you up at night, going uninsured could put you at risk for steep legal and financial trouble if an accident happens. This article highlighted just how narrowly focused third party cover is and how easy it is to miss those hidden gaps. If you need the right balance between saving on monthly costs and protecting yourself from unexpected third party expenses, now is the time to make a smarter choice.

Take the first step to stress-free driving and get advice or a quote that matches your exact situation. Check out Savvy Insurance for simple car insurance tips, practical solutions and real answers about third party car insurance. Why wait until an accident knocks on your wallet? Visit our website today, compare your options, and find real cover and peace of mind before your luck runs out.

6 Responses